A Coach House Revival

Aug 20, 2020

Chicago is facing a population decline. For the past five years, more people are leaving the city than are coming in, a steady stream that is almost twice the rate of the exodus from New York City. A declining population has serious ramifications for a city, affecting everything from federal funding allotments to the health of the regional economy. And while many factors can play into the decision to move away, one factor in particular rears its head over and over again: Chicago’s lack of affordable housing for aspiring homeowners. To be clear, this is not just a Chicago problem — national home ownership among millennials is down 8 points from Gen Xers and Baby Boomers when they were in the same age range. But compared to the national homeownership average of 65%, Chicago homeownership is stuck at 45.7%. And it’s not that millennials don’t want to buy a house — when asked to cite the reason why they weren’t homeowners, 53% of millenials answered that it was because they couldn’t afford a downpayment, versus the 21% who said they prefer to rent. In their “Overview of Chicago’s Housing Market” the Institute for Housing Studies at DePaul University pointed out that maintaining a mortgage in one’s neighborhood market type would be impossible for many due to the price point of entering said market. Only 28% to 34% of Chicago renters could currently afford a mortgage in their neighborhood. And given that home ownership is critical to building equity (home owners have an average net worth 44 times that of renters), it’s no surprise that many people seeking home ownership decide to move out to greener, more affordable pastures. If Chicago wants to head off its population decline and all the negative effects, it needs to provide affordable housing in short order. But how to quickly and efficiently take on the complex, immense problem of Chicago housing?

Maybe it’s best to start small.

Enter “Coach,” Level Architecture’s plan for tackling Chicago’s affordable housing problem. Coach alludes to Coach Houses, formally known as Accessory Dwelling Unit (ADU) along with a milieu of other less formal nicknames. An ADU is traditionally known as a secondary smaller residence located on the same property as a single-family home or multi-flat building. ADUs gained traction in Chicago during a Bohemian building boom of the early 1900s. In a report by WBEZ Curious City, the station chronicles a working-class immigrant group that gained a foothold in Chicago by first building small cottages which they parlayed into the construction of two-flats. The new buildings provided passive income as well as the opportunity for multiple generations to live together in different ways over time. Legal ADU’s were constructed until the 1950s, when they were banned as fears of overcrowding grew in the post WWII economy. But, as cities look for inventive ways to improve home equity and increase housing options for new homeowners, they might consider advocating for the very thing they once outlawed. In other words, the Coach House is poised for a comeback.

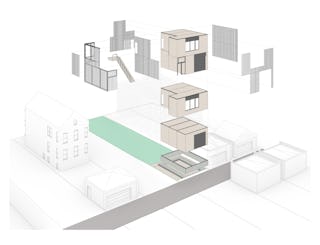

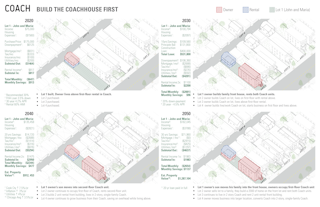

We’ve built upon the historical configuration of ADUs to create “Coach,” a modern day implementation plan. Coach is a powerful tool to increase wealth for homeowners. The basic premise is this: Coach will provide low-cost starter homes that allow a homeowner to build equity, generate income on site, and age in place. Coach proposes a phased investment in a typical Chicago lot where the coach house gets built first. Under current zoning this is not possible; the primary building on a site must be built first. The Coach proposal aims to reduce the initial cost of the home to be affordable ($175,000). This will be achieved by two factors: a small building footprint which reduces the amount of material, systems, and labor required, and the use of apprenticed construction labor. The average footprint of a Coach house is just over 525 square feet, with a total area of 1,050 square feet across two floors. Offering construction training will not only lower the labor cost through potential DIY savings, it also creates opportunities for local residents to learn skills and fill these good-paying jobs while addressing the shortage of skilled labor in the construction industry. This low initial investment allows new homeowners to own a piece of property they gradually expand to include rental units for supplemental income.

One of the prominent benefits of Coach is its flexible nature. Rather than locking participants into a single plan, Coach has multiple configurations to fit the needs and interests of individuals. Coach can offer three methods of providing supplemental income. The first is real estate appreciation: as neighborhoods embrace investment and engagement through ownership, property values increase over time along with the value of the equity in the property. Secondly, owners can rent out part or all of their property for income which is used to supplement or even fully cover mortgage payments and build equity as they pay down their mortgage. Owners can also choose to utilize part of the property, say the first floor of the original Coach house, as a shop or office space for their own business. The final opportunity is the 95 feet of front yard included in the plan, which could be used for everything from an urban garden to renewable energy generation like solar panels, potentially either adding additional income or reducing utility costs.

Not only do these diverse configurations allow for a wide range of income sources, it also helps residents age in place. Aging in place is a valuable option for individuals and their communities. For the individual, it provides stability and decreased moving or assisted living costs. For the community, it ensures that families will continue to stay and invest in the neighborhood as they age and acquire more wealth, which in turn strengthens the financial health of the area. Owners are able to take advantage of the various living arrangements as they progress through life, perhaps moving into a larger apartment as they raise a family but returning to the smaller first floor of the carriage house in their elder years for greater accessibility and reduced home upkeep. These multiple configurations provide stability, security, and accessibility over decades and generations.

To fully explore the wide scope of possibilities of Coach, imagine Bronzeville residents John, a graphic designer, and his new wife Maria, an elementary school teacher. Both are only a few years into their careers and are still saddled with student loan debt. Growing tired of increasing apartment rent, they are interested in becoming homeowners but are struggling to find something that they can afford in the neighborhood. This is where Coach comes in. John and Maria decide to buy an empty lot and build a coach house first using apprenticed construction labor — the $175,000 investment requires a downpayment of $6,125.

On Day 1 of residence in their finished home, John and Maria live on the second-floor while renting the first-floor apartment to IIT students. Several years go by, and they have finally saved enough to build a single family house in front of the Coach house. They refinance their home, and are able to take advantage of the improvements they have made to the empty lot. While this obviously increases their mortgage, and their monthly payment, they also now have two apartments they can rent out. They move into the front house and start a family, while either renting both affordable Coach house apartments for passive income, or perhaps John decides to start his own graphic design shop and uses the first-floor for his business. As time passes and their children grow and start careers, their oldest son Jack moves into the second-floor apartment of the Coach House. The family continues to offer the affordable and accessible first-floor Coach house apartment for rent. When Jack begins a family of his own, John and Maria move into the accessible first-floor apartment, while Jack and his family move into the single-family front house. The family can continue to rent out the affordable second-floor apartment for passive income, while they grow and age on the same lot they purchased all those years ago.

Over the course of thirty years, John and Maria have turned their $175,000 investment and a downpayment of $6,125 into a property worth approximately $1,287,104 with the mortgage paid in full.

Coach could prove to be the future of new home ownership in Chicago, providing a welcome relief to young first time buyers. It’s also unique in its ability to provide an opportunity for job-seekers to gain valuable training. A 2018 survey by Associated General Contractors of America (AGC) and Autodesk reports that in Illinois “68 percent of the 60 companies surveyed reported having a hard time finding trades workers…The greatest difficulties in hiring are for pipefitters/welders, painters, and bricklayers.” Coach addresses this with ample labor positions. These dual benefits offer exciting opportunities for Chicago to create a benchmark for affordable housing. Level has been working with a ULI ADU taskforce comprised of local architects, developers, real estate professionals, and City of Chicago Officials to help advise City Council on the language of the new ADU ordinance. To learn more, check out The ULI report here, and the draft ordinance (Record #O2020-2850) expected to be approved by city council in August of 2020 here.